High-Tech and Market Bubbles Through History: Difference between revisions

(New page: == High-Tech and Market Bubbles Through History == The year is 1284, about 14 years after the introduction in Venice of a high-tech electrical positioning technology developed from a Chin...) |

No edit summary |

||

| (12 intermediate revisions by 5 users not shown) | |||

| Line 1: | Line 1: | ||

== High-Tech and Market Bubbles Through History == | == High-Tech and Market Bubbles Through History == | ||

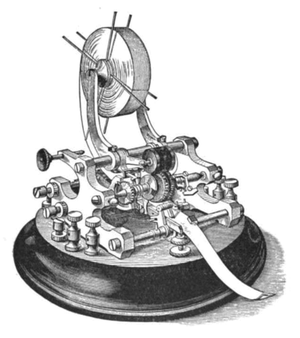

[[Image:Stock ticker.png|thumb|right|Stock Ticker]] | |||

Historically, technology has led to speculative frenzies in financial markets in two ways. First, it provides opportunities to invest in new, exciting, but often little-understood, high-risk/high-reward companies. Second, it exacerbates market swings by accelerating information exchange and improving the way share transactions are processed. | |||

<p>Hard on the heels of [[Lee De Forest|de Forest’s]] [[Radio|radio]] stock irregularities came the famous [[Guglielmo Marconi|Marconi]] scandal. Marconi himself was not involved; the scandal involved insider trading of Marconi Company shares by British cabinet officers and some of their families. In some ways, the Marconi scandal was similar to the insider access to IPOs that occurred in the 1990s. In 1911-1912, the British government negotiated with the British Marconi Company to build a series of wireless transmitting and receiving stations to connect Britain’s colonies. On 7 March 1912, a tender was signed for the first six stations, and the government and Marconi officials began working on the terms of the actual contract. That same March, the American Marconi Company decided to increase its capitalization by a huge new share issue. </p> | |||

[[Image:MarconiCoStation.jpg|thumb|right|In 1919, the old New Brunswick, New Jersey Marconi Company Wireless Station on Easton Avenue in the Somerset section of Franklin Township, Somerset County, New Jersey became part of the newly organized Radio Corporation of America (RCA). Source: Franklin Township Public library archive http://www.franklintwp.org/photoarchive/photodb/nhetl5zcis8jiz764pvxr3x8q2q2m9t5.asp]] | |||

In April, British Marconi Company director Godfrey Isaacs offered some of these new shares to his brother, the Attorney General, and others, even though the shares were not yet approved and not yet available to the public. Ten days later, the shares opened on United States and British exchanges, closing the day at a value of roughly four times what the insiders had paid for them. | |||

<p>In linguistic hair-splitting afterwards, the government officials claimed that what they had done was not improper because they had bought shares in the American Marconi Company while negotiating a contract with its British counterpart. The public was not amused by the distinction, especially when the American Marconi stock, after a brief run-up, sank back to its original-- and more rational-- level. </p> | |||

<p>The 1990s were not the first time that high-tech stocks outran their price-earnings ratios. In 1929, [[RCA (Radio Corporation of America)|RCA]] shares leapt from $114 per share in February-- already a huge run-up-- to a high of $572, before plunging to $10 in the October crash. RCA was not unusual in the six-year boom market, which began in 1923. By 1929, share volume on the NYSE had grown so much that the Exchange installed a central quote system to provide instantaneous bid-ask prices via telephone. The frenzy was heating up. </p> | |||

<p>Technology-- specifically computerized program trading-- was also blamed for the New York Stock Exchange’s largest one-day drop, the 508 point “meltdown” on “Black Monday” 19 October 1987. That particular drop was caused by a huge imbalance of sell orders, triggered mostly by a drop in futures prices. The proliferation of computers in the financial world had made the almost instant transfers of large blocks of capital from market to market anywhere in the world possible, to take advantage of even momentary and small differences in commodity or futures prices. Liquidity could vanish suddenly and with no warning. Many exchanges established trading “collars” to contain volatility, by halting trading if limits were exceeded. </p> | |||

== Year 2000 == | |||

The high tech boom / bust cycle witnessed around 1999-2001 was a very clever ploy by marketeers on uninformed investors. This was also around the time when the Y2K ‘bug’ was being promoted as akin to the end of the world, or rather selling the idea that no-body knew what would happen to the world at midnight on Dec 31st 1999. Of course the reality was a total non-event, but by that time, Banks, industry, manufacturing and utilities had spend literally hundreds of millions of dollars on consultants, testing labs, certifiers and even having large quantities of support staff monitor the new years transition to year 2000. | |||

This coincided with the tech boom prompted by the deregulation of monopoly telecommunications carriers. Many stocks surged on the promise of CEO forecasts, but rudimentary analysis showed no revenue streams or revenue forecasts that could never be achieved. A classic case was a company making an annual revenue forecast for sale of Telco services mainly for public use. A quick calculation showed the forecast amount equated to ‘every person in the whole country’ spending $80 on their services – and there was absolutely no-way to see how this could possibly happen in reality. No surprise they went bust about 18 months later. | |||

<p>Using either history or technology to explain or predict the stock market is always risky, but what has happened before has happened again. </p> | |||

[[Category:Business,_management_&_industry]] | |||

[[Category:Business]] | |||

[[Category:Economics]] | |||

Revision as of 21:30, 19 January 2012

High-Tech and Market Bubbles Through History

Historically, technology has led to speculative frenzies in financial markets in two ways. First, it provides opportunities to invest in new, exciting, but often little-understood, high-risk/high-reward companies. Second, it exacerbates market swings by accelerating information exchange and improving the way share transactions are processed.

Hard on the heels of de Forest’s radio stock irregularities came the famous Marconi scandal. Marconi himself was not involved; the scandal involved insider trading of Marconi Company shares by British cabinet officers and some of their families. In some ways, the Marconi scandal was similar to the insider access to IPOs that occurred in the 1990s. In 1911-1912, the British government negotiated with the British Marconi Company to build a series of wireless transmitting and receiving stations to connect Britain’s colonies. On 7 March 1912, a tender was signed for the first six stations, and the government and Marconi officials began working on the terms of the actual contract. That same March, the American Marconi Company decided to increase its capitalization by a huge new share issue.

In April, British Marconi Company director Godfrey Isaacs offered some of these new shares to his brother, the Attorney General, and others, even though the shares were not yet approved and not yet available to the public. Ten days later, the shares opened on United States and British exchanges, closing the day at a value of roughly four times what the insiders had paid for them.

In linguistic hair-splitting afterwards, the government officials claimed that what they had done was not improper because they had bought shares in the American Marconi Company while negotiating a contract with its British counterpart. The public was not amused by the distinction, especially when the American Marconi stock, after a brief run-up, sank back to its original-- and more rational-- level.

The 1990s were not the first time that high-tech stocks outran their price-earnings ratios. In 1929, RCA shares leapt from $114 per share in February-- already a huge run-up-- to a high of $572, before plunging to $10 in the October crash. RCA was not unusual in the six-year boom market, which began in 1923. By 1929, share volume on the NYSE had grown so much that the Exchange installed a central quote system to provide instantaneous bid-ask prices via telephone. The frenzy was heating up.

Technology-- specifically computerized program trading-- was also blamed for the New York Stock Exchange’s largest one-day drop, the 508 point “meltdown” on “Black Monday” 19 October 1987. That particular drop was caused by a huge imbalance of sell orders, triggered mostly by a drop in futures prices. The proliferation of computers in the financial world had made the almost instant transfers of large blocks of capital from market to market anywhere in the world possible, to take advantage of even momentary and small differences in commodity or futures prices. Liquidity could vanish suddenly and with no warning. Many exchanges established trading “collars” to contain volatility, by halting trading if limits were exceeded.

Year 2000

The high tech boom / bust cycle witnessed around 1999-2001 was a very clever ploy by marketeers on uninformed investors. This was also around the time when the Y2K ‘bug’ was being promoted as akin to the end of the world, or rather selling the idea that no-body knew what would happen to the world at midnight on Dec 31st 1999. Of course the reality was a total non-event, but by that time, Banks, industry, manufacturing and utilities had spend literally hundreds of millions of dollars on consultants, testing labs, certifiers and even having large quantities of support staff monitor the new years transition to year 2000.

This coincided with the tech boom prompted by the deregulation of monopoly telecommunications carriers. Many stocks surged on the promise of CEO forecasts, but rudimentary analysis showed no revenue streams or revenue forecasts that could never be achieved. A classic case was a company making an annual revenue forecast for sale of Telco services mainly for public use. A quick calculation showed the forecast amount equated to ‘every person in the whole country’ spending $80 on their services – and there was absolutely no-way to see how this could possibly happen in reality. No surprise they went bust about 18 months later.

Using either history or technology to explain or predict the stock market is always risky, but what has happened before has happened again.